Posted

The Digital Operational Resilience Act (DORA) is pushing companies across Europe to demonstrate something many have struggled with for years: measurable resilience. It’s no longer enough to check the compliance box or hand over a set of controls during an audit. Regulators want evidence that organizations can withstand, respond to, and recover from ICT disruptions.

That’s a fundamental shift. And for CISOs and risk leaders, it highlights the need to finally close the long-standing gap between cybersecurity operations and compliance reporting.

Compliance Alone Doesn’t Equal Resilience

From dozens of recent customer and prospect conversations, a pattern is clear: many organizations have frameworks, standards, and regulatory reporting already in place. But too often, those exercises live in spreadsheets, disconnected from day-to-day security operations.

Teams described risk assessments that still rely on heatmaps and qualitative scoring. These visuals may satisfy a governance report, but they don’t hold up when boards or regulators ask tough questions like: “How much exposure do we really face in euros? What impact will this control have? Which vulnerabilities should be patched first?”

DORA makes those questions unavoidable. And it raises the bar by demanding demonstrable resilience. That requires quantifiable, defensible, and dynamic risk data—grounded in financial impact and directly linked to security operations.

Why Risk Quantification is Central to DORA

The organizations preparing most confidently for DORA share several practices that come straight from the risk quantification playbook:

- Translating cyber risk into financial terms. Executives and regulators both understand money. By showing, for example, that a vulnerability represents €5M in potential annual loss, and that remediation can halve that exposure, security leaders can present a compelling, defensible business case. The same approach can also be used to demonstrate the organization’s ability to be resilient and recover operations quickly.

- Making calculations transparent. It’s not enough to show a score; the methodology must be clear. Teams want to show how CVEs, controls, and likelihood data combine into the final number. That transparency builds trust internally and externally.

- Keeping assessments continuous. Static risk registers don’t cut it anymore. Organizations want live data from SIEMs, vulnerability scanners, threat intelligence, and more feeding into dynamic models that reflect today’s environment, not last quarter’s.

- Going granular. Enterprise-level averages aren’t enough when resilience depends on a critical application, a line of business, or an OT environment. DORA expects risk to be visible at those levels too.

- Automating the heavy lifting. With regulatory deadlines and finite resources, manual FAIR spreadsheets or ad hoc modeling are too slow. Traditional ways of measuring risk do not provide enough defensibility to take a proactive approach to managing risk. Teams are looking for automation to refresh scenarios, update dashboards, and generate board-ready reports without endless manual effort.

These practices align almost perfectly with DORA’s requirements: credible evidence of resilience, backed by defensible numbers, delivered in a way that bridges technical detail and executive oversight.

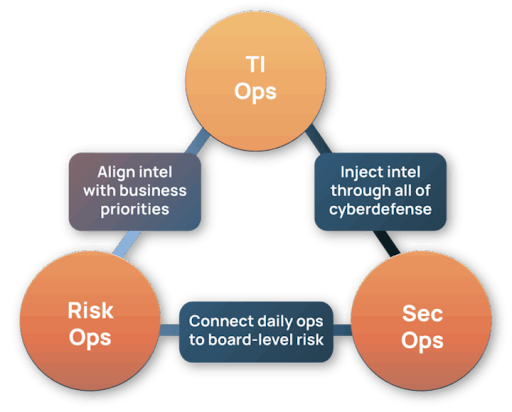

How ThreatConnect Helps Close the Gap

This is exactly where the ThreatConnect Intel Hub fits. With Risk Quantifier at the core, ThreatConnect provides a platform that makes DORA-style resilience practical:

- Quantify risk in business terms. ThreatConnect translates cyber risk into monetary values, enabling clear prioritization of vulnerabilities, scenarios, and investments.

- Provide defensible, transparent methodologies. Calculations are mapped to frameworks like NIST, FAIR, and MITRE ATT&CK, so teams can show their work with confidence.

- Integrate with the existing ecosystem. From Tenable to ServiceNow to threat intelligence feeds, ThreatConnect ingests and correlates data for a real-time, unified risk picture.

- Automate scenarios and reporting. Playbook-driven automation enables “what-if” modeling and keeps dashboards current without excessive manual intervention.

- Deliver board-ready outputs. Interactive dashboards and tailored reports make it easy to communicate risk posture to executives and regulators, in the language of financial exposure and resilience with defensible resilience.

The result: organizations not only meet compliance obligations under DORA, but also gain a foundation for smarter, faster, more risk-informed security decisions.

Turning DORA Into an Advantage

Viewed narrowly, DORA is another compliance hurdle. Viewed strategically, it’s a forcing function that accelerates maturity.

By adopting risk quantification, financial institutions can:

- Justify investments with hard numbers instead of gut feel.

- Prioritize remediation based on real business impact.

- Build trust with boards and regulators through transparent reporting.

- Reduce analyst burnout by focusing on what matters most.

- Create resilience that lasts beyond the next audit cycle.

In short, DORA compliance can be a catalyst for lasting operational improvement.

The Bottom Line

Resilience is not just built from checklists. It’s built from decisions: where to focus, what to fix, how to invest. DORA demands evidence of those decisions.

ThreatConnect helps organizations deliver it—by uniting intelligence, risk quantification, and security operations into a single Intel Hub. The result is more than compliance. It’s a defense that’s financially grounded, operationally integrated, and provably resilient.

Ready to see how ThreatConnect can turn DORA into an advantage? Request a demo!